Zywave Releases 2017 Health Plan Design Benchmark Report

By The Bailey Group Marketing

Published April 10, 2018

Data nerds, rejoice! Zywave’s 2017 Employee Benefits Benchmark Report has officially been released.

Zywave, a privately held company headquartered in Milwaukee, Wisconsin, is the leading provider of software-as-a-service (SaaS) technology solutions for the insurance industry.

The benchmark report they’ve released is the result of an analysis that was performed on Zywave’s proprietary database of more than 40,000 employer-sponsored plans. Their analysis focused on:

- The trends that emerged from the aggregate data over the past five years;

- What differences occurred in plan designs between small employer plans and large employer plans; and

- How plan types responded to economic and regulatory conditions.

It is important to note that the data used to compile the summary was from the 2017 calendar year, so it is the most recent complete data set available in 2018.

A copy of the full report can be downloaded here. For those looking for a summary, here we go …

The broad shift in plan components seems to be driven by increasing health care costs.

In most of the plan components Zywave analyzed, they saw broad shifts away from levels that are less expensive for employees toward levels that expose employees to additional costs. These shifts started occurring before many of the ACA provisions took effect and were gradual and broad enough to suggest that these movements were in reaction to the increasing costs of health care—a trend that has been ongoing for more than a decade.

ACA requirements seem to have had a major impact on some plan components.

While there continues to be a somewhat gradual reaction to the increasing costs of health care within most plan components, in some components, Zywave sees this accelerated dramatically by the ACA’s requirements.

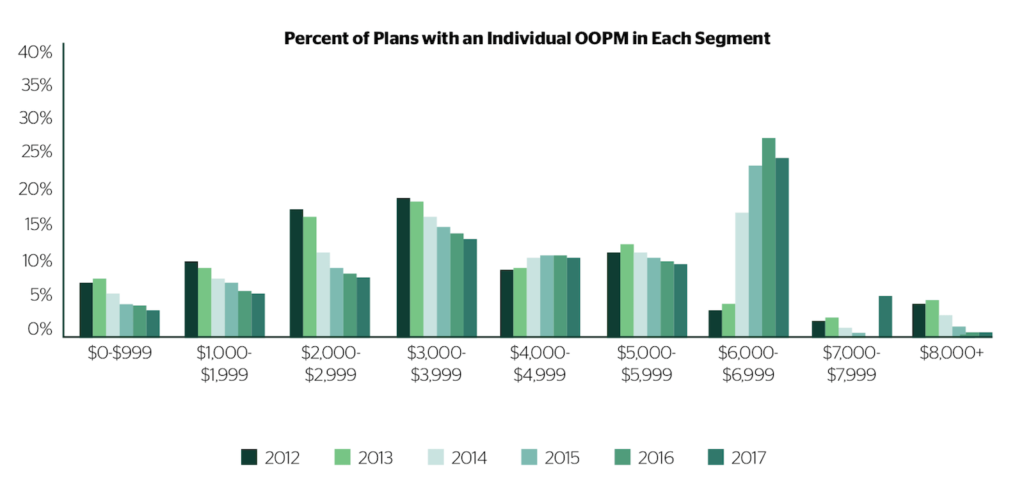

In components like the individual out-of-pocket maximum (OOPM), they see a dramatic shift that occurs from 2013 to 2014, which is likely a result of the cost-sharing limits that became effective at this time. In these instances, employers seemed to use the OOPM limit as a benchmark for what is acceptable and rapidly adopted plans near this limit. This theory seems to be given additional credibility by the 2017 data, as plans seemed to rapidly adopt the 2017 individual OOPM limits.

If the ACA is completely repealed at some point by the Trump administration, or if any replacement legislation removes these limits, we would likely not see a significant reduction in the average OOPM. Instead, we would expect to see a continued increase in the average OOPM. Because employers have already moved toward higher OOPM levels, it would be a significant expense to reduce those levels. A decrease would likely only occur if necessitated by a dramatically increased level of competition for talented employees.

Healthy employees seem to be more insulated from increasing costs than unhealthy employees.

The average amount for plan components like the emergency room (ER) copay and the OOPM have seen more dramatic increases than the averages for components like office visit copays or individual deductibles. Zywave believes that this is the result of employers’ attempts to shield the average employee from feeling the increasing cost of coverage.

Only a handful of employees on any given plan may have to pay the full OOPM or ER copay amount, while many employees will likely hit a deductible limit, and nearly all employees will have to pay an office visit copay. While this protects the average healthy employee from realizing the full cost increase, this has the unintended consequence of exposing unhealthy employees to a larger share of the cost increase.

Large employer and small employer plans are becoming increasingly similar.

Over the past six years, the differences between large and small employer plans have narrowed. For most plan components, the differences between the percent of small employer plans (50 or fewer employees) in a given segment and the percent of large employer plans in that segment decreased.

The differences that do still exist are typically the result of large employers offering more generous plan designs than small employers. This is likely due to large employers’ increased emphasis on attracting top talent and relatively lower price sensitivity.

Different plan types react similarly to regulation and economic conditions.

After analyzing the five most represented plan types in the data set, Zywave found that, on average, each plan type reacted in a similar way to changing market conditions. So while different plan types migrated to less generous plan components at different rates over the years, the change between plan types in each pricing segment was effectively zero. This trend indicates that generally all plan types reacted similarly to market conditions in a manner consistent with the inherent strategy of each plan type.

That pretty much sums things up. Again, for those looking for a deep dive, the full benchmark report can be found here.