Supreme Court Ruling on DOMA and What It Means for Employers

By The Bailey Group Staff

Published June 28, 2013

On June 26, 2013, the U.S. Supreme Court announced its decision regarding the constitutionality of the federal Defense of Marriage Act of 1996 (DOMA). The Court struck down Section 3 of DOMA, which limited marriage to opposite sex unions for purposes of federal law.

In a 5-4 decision, the court found this definition to be a violation of equal protection rights under the U.S. Constitution, holding that same-sex couples who are legally married under state law will be entitled to equal treatment under federal law with regard to income taxes and federal benefits. However, the Court’s ruling does not establish a constitutional right to same-sex marriage.

This decision will impact employers in states that recognize same-sex marriage with respect to things like:

- Taxation of employee benefits;

- Leave under the Family and Medical Leave Act (FMLA); and

- Enrollment rights under HIPAA and COBRA.

Background of the Defense of Marriage Act (DOMA)

Enacted in 1996, DOMA banned federal recognition of same-sex marriage by defining “marriage” as the legal union between one man and one woman as husband and wife. As a result of the Supreme Court’s ruling in U.S. v. Windsor, legally married same-sex couples are entitled to the same benefits and protections under federal law as opposite-sex married couples.

The Court’s ruling does not require states to permit same-sex marriage. Also, the Court did not address the part of DOMA that allows states to choose whether to recognize same-sex marriages performed in other states. This means that states can still refuse to recognize same-sex marriages that are legal in other states.

Effect of Supreme Court Decision on Employee Benefits

DOMA has not prohibited employers from providing health benefits to their employees’ domestic partners or same-sex spouses. However, the administration and taxation of these benefits can be complex. In states that recognize same-sex marriage, DOMA created two different systems for same-sex couples. Under state law, these couples were treated as married, but their marriages were not recognized under federal law.

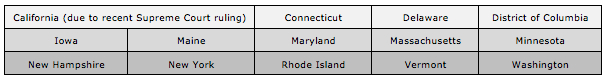

The majority of states have laws or constitutional amendments barring same-sex marriages. However, a growing number of states have legalized same-sex marriage, while others recognize same-sex marriages performed in other states and nations. The states that have legalized same-sex marriage include:

Due to the Supreme Court’s DOMA ruling, employers in jurisdictions that allow or recognize same-sex marriage must treat employees’ same-sex and opposite-sex spouses equally for purposes of federal employee benefit laws. For example, in states that permit or recognize same-sex marriages, the Court’s decision makes the following changes with respect to employee benefits:

- An employer will no longer need to impute additional income to an employee who covers his or her same-sex spouse as a dependent under the employer’s health plan;

- An eligible employee may pay for a same-sex spouse’s health coverage on a pre-tax basis through a cafeteria (or section 125) plan in the same way as an employee with an opposite-sex spouse;

- An eligible employee may receive tax-free reimbursements for expenses of his or her same-spouse through a health flexible spending account (FSA), health reimbursement account (HRA) or health savings account (HSA);

- A same-sex spouse is considered a spouse or family member for purposes of taking leave under the federal Family and Medical Leave Act (FMLA);

- Special enrollment rights under HIPAA are triggered when an employee acquires a same-sex spouse; and

- Same-sex spouses may qualify as a “spouse” for COBRA purposes and can have their own COBRA election rights.

It is likely that federal agencies will provide more specific guidance on how the Supreme Court’s DOMA decision impacts the laws they enforce.

Domestic Partnerships and Civil Unions

The Supreme Court’s DOMA decision applies only to same-sex marriages that are valid under state law. It does not affect same-sex couples in civil unions or domestic partnerships. These couples will generally remain ineligible for the federal benefits and protections provided to spouses.

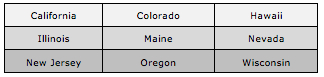

A small number of states have passed laws allowing same-sex civil unions or domestic partnerships that offer some state-level rights and protections similar to marriage. These states include:

For same-sex couples in civil unions or domestic partnerships, domestic partner benefits are non-taxable only if the domestic partner qualifies as a dependent under the Internal Revenue Code’s definition of “qualifying relative.” To qualify as a dependent under this definition, the domestic partner must generally:

- Have the same primary address as the employee/taxpayer for the year;

- Be a member of the employee/taxpayer’s household;

- Receive more than half of his or her support for the year from the employee/taxpayer;

- Not be anyone’s “qualifying child” for tax purposes; and

- Be a citizen or national of the U.S., or a resident of the U.S. or a country contiguous to the U.S.

If a domestic partner does not qualify as a tax dependent of the employee, employers are required to report and withhold taxes on the value of employer-provided health coverage for the domestic partner. In addition, an employee cannot pay for a domestic partner’s coverage on a pre-tax basis through a cafeteria (or section 125) plan if the partner is not the employee’s tax dependent.

It is common for employers to “gross up” an employee’s salary to offset the tax consequences of domestic partner benefits (that is, reimburse employees for the extra taxes they are required to pay on the value of domestic partner benefits).

Compliance Steps

Employers may receive questions and benefit requests from employees who have entered into a same-sex marriage, or are planning to do so in the future. While waiting for additional guidance from federal and state regulators regarding the impact of the Supreme Court’s decisions, employers in states that have legalized same-sex marriage should consider the following compliance steps:

- Update payroll systems to treat legally married same-sex couples as spouses and stop imputing income to employees for tax-free employee benefits provided to a same-sex spouse;

- Review employee benefit policies and procedures to confirm that they treat legally married same-sex couples as spouses and make any necessary updates; and

- Communicate benefit changes affecting same-sex spouses to employees.

A copy of the Supreme Court’s decision is available at www.supremecourt.gov/opinions/12pdf/12-307_6j37.pdf.

Photo Credit: tedeytan