Should Your Company Choose a Defined Contribution Health Plan?

By The Bailey Group Staff

Published May 15, 2013

The heightened interest in defined contribution health plans is mainly due to the increasing costs of health coverage and changes made by the health care reform law, or the Affordable Care Act (ACA).

Under a defined contribution health plan, an employer gives its employees a fixed contribution to purchase health insurance coverage. Employees use that money to buy or help pay for a health insurance plan they select for themselves. The concept of a defined contribution employee benefit is not new; most employees are familiar with the defined contribution approach through their retirement benefits. However, recently there has been an increased interest in the defined contribution approach to health benefits.

Because defined contribution health plans are a relatively new trend, it is not yet clear whether employees will find this arrangement acceptable and whether it will be a competitive advantage or disadvantage in the employer’s labor market.

Overview of defined contribution approach

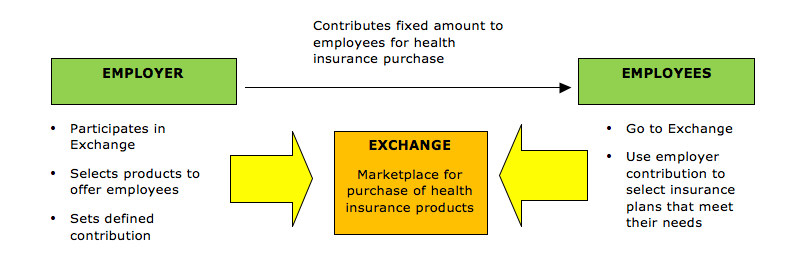

The following is a conceptual overview of the defined contribution health plan model:

The defined contribution approach gives employees more choice and responsibility when choosing health coverage. It also allows the employer to limit its financial contribution for employees’ health coverage to a fixed amount, which moves the risk of premium increases to its employees. However, some employees may be skeptical about the defined contribution approach and may prefer the traditional model of health coverage. This could put an employer at a disadvantage in the marketplace if its competitors continue to offer traditional health coverage for their employees.

Employer Contributions

HRAs

To maximize tax savings under a defined contribution health plan, employers have typically established health reimbursement accounts (HRAs) for making their contributions. Unlike health flexible spending accounts (FSAs) and health savings accounts (HSAs), HRAs can be used to reimburse health insurance premiums. Also, unlike an HSA, an individual does not need to be covered under a high-deductible health plan (HDHP) to participate in an HRA. This has made HRAs particularly compatible with defined contribution health plans.

Effective for 2014, ACA prohibits all annual limits on essential health benefits. Whether an HRA will be permitted under ACA’s annual limit rules mainly depends on whether the HRA is an “integrated HRA” or a “stand-alone HRA.” Employers using HRAs in connection with their defined contribution health plans should examine their HRAs to make sure they are compliant for 2014.

Integrated HRAs

An HRA integrated with other group health coverage is not required to satisfy ACA’s annual limit restrictions if the other coverage alone satisfies the annual limit restrictions. An HRA is considered integrated with an employer’s group health coverage if, under the terms of the HRA, the HRA is available only to employees who are covered by employer-sponsored coverage that meets ACA’s annual limit requirements.

A set of frequently asked questions (FAQs) from January 2013 addresses when an HRA is considered “integrated” with other coverage. In the FAQs, the federal agencies in charge of implementing ACA state that they intend to issue the following future guidance on HRAs:

- An employer-sponsored HRA cannot be integrated with individual market coverage or with an employer plan that provides coverage through individual policies.

- An employer-sponsored HRA may be treated as integrated with other coverage only if the employee receiving the HRA is actually enrolled in that coverage.

Stand-alone HRAs

Some stand-alone HRAs are not subject to ACA’s annual limit restrictions because they fall under an exception, such as retiree-only HRAs, vision-only or dental-only HRAs and certain HRAs that qualify as health FSAs. However, beginning in 2014, stand-alone HRAs that do not fall under an exception will not be permitted due to ACA’s prohibition on annual limits. This generally means that employers will not be able to offer a stand-alone HRA for employees to purchase individual coverage, inside or outside of an Exchange.

However, the FAQ guidance gives stand-alone HRAs more time to comply with the annual limit restrictions with respect to amounts credited before 2014.

Cafeteria Plans

Another way for employers to maximize tax savings is to make their employee health insurance contributions through a Section 125 Plan, or a cafeteria plan. Employers can offer the employees “credits,” or employer money, under a cafeteria plan that can be used to purchase qualified benefits, such as major medical insurance.

Under ACA, individual health coverage offered through an Exchange generally will not constitute a qualified benefit that can be purchased on a pre-tax basis through a cafeteria plan. However, Exchange coverage may be funded through a cafeteria plan if the employee’s employer is eligible to participate in the Exchange and elects to make group coverage available.

Marketplaces for Coverage

Public Exchanges

Effective Jan. 1, 2014, ACA requires each state to have an Exchange to provide a competitive marketplace where individuals and small businesses will be able to purchase affordable private health insurance coverage. The Department of Health and Human Services (HHS) will operate a federally facilitated Exchange (FFE) in any state that does not establish its own Exchange.

Individuals and small employers with up to 100 employees will be eligible to participate in the Exchanges. However, states may limit employers’ participation in the Exchanges to businesses with up to 50 employees until 2016. Beginning in 2017, states may allow businesses with more than 100 employees to participate in the Exchanges. Enrollment in the Exchanges is expected to begin on Oct. 1, 2013.

Each ACA Exchange will have Small Business Health Options Program (SHOP) to assist eligible small employers to provide health insurance for their employees. A SHOP must allow employers the option to offer employees all qualified health plans (QHPs) at a level of coverage selected by the employer—bronze, silver, gold or platinum. In addition, SHOPs may allow an eligible employer to choose one QHP for its employees.

On March 11, 2013, HHS issued a proposed rule that would delay implementation of the employee-choice model as a requirement for all SHOPs until 2015. For 2014, the FFE’s SHOP would not allow eligible employers to offer their employees a choice of QHPs at a single level of coverage and would assist employers in choosing a single QHP to offer to their employees. Under the proposed guidance, the employee-choice SHOP model would be optional for state-based Exchanges for 2014.

Private Exchanges

Private health insurance exchanges are emerging as an alternative to ACA’s public Exchanges. When using a private exchange, employers contract with the exchange, set a defined contribution and select the health insurance products to be offered to employees. Employees then go to the exchange’s online marketplace and, using the employer contribution, select a plan from the available options.

Private exchanges can provide more flexibility than ACA’s Exchanges.

- Private exchanges can offer a broader range of insurance products, such as life insurance, and their products can be tailored for different employer segments.

- Although ACA prohibits large employers from using the Exchanges until at least 2017, there is no similar restriction for private exchanges. Thus, small and large employers can use private exchanges to provide group health insurance benefits to their employees.

- Private exchanges are currently operating to provide employees with a choice of health insurance products, while the SHOP’s employee choice model will likely be delayed until 2015.

Private health insurance exchanges are a relatively new model for providing group health insurance benefits. The availability and success of private exchanges most likely depends on employers’ willingness to move from a traditional health plan to a defined contribution health plan.