Employer Mandate Delayed For “Medium-Sized” Employers Until 2016

By The Bailey Group Marketing

Published February 13, 2014

Large and medium-sized businesses received some much-anticipated news out of the IRS earlier this week.

On Monday, Feb. 10, 2014, Final regulations were released relating to the Affordable Care Act’s employer mandate requirement and it added some very important details to the previous guidance released on Dec. 27, 2012.

Here are some of the biggest changes you will need to know.

Delay for Medium-Sized Employers

The employer mandate has already been delayed once from a Jan. 1, 2014 effective date to a Jan 1., 2015 effective date. This new announcement from the IRS gives employers with 50-99 full-time equivalent employees until Jan. 1, 2016 to comply with the employer mandate.

Employers must meet certain criteria to make sure they will qualify for this delay. They must:

- Not reduce the size of their workforce or overall hours of employees through 2014;

- Continue or increase employer contributions toward coverage from Feb.9, 2014, through the end of the 2015 plan year;

- Complete and attach a certification to their Section 6056 report (due Jan. 2016), which requires employers to report the health care coverage offered to full-time employees.

Employers with 100 or more full-time and full-time equivalent employees will still be required to begin complying with the employer mandate requirement on Jan. 1, 2015. Groups with non-calendar-year plans may be delayed until the first day of the new plan year in 2015. Those plans must have been in place before Dec. 27, 2012 and not have changed plan years thereafter.

A Decrease from 95% to 70%

Before this latest announcement, the employer mandate required businesses with over 50 full-time equivalent employees to offer coverage to substantially all of its full-time employees or face a penalty. Substantially all was previously defined as 95%.

Under this new guidance, employers must now offer minimum essential coverage to at least 70% of their full-time employees in 2015. That number will then jump back to 95% in 2016.

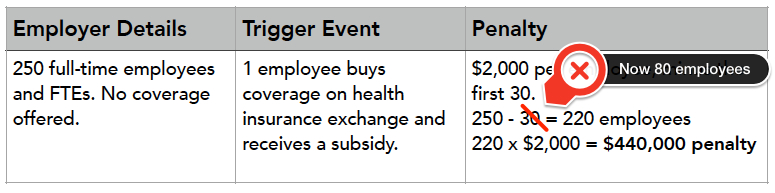

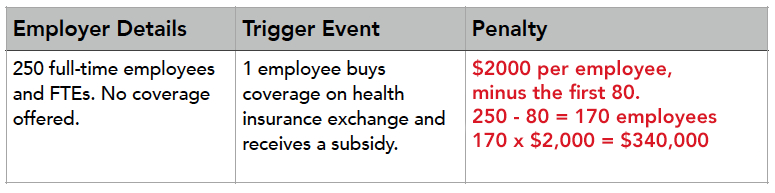

Also of note, employers will be exempt from paying a penalty on the first 80 employees instead of 30 in 2015. I’ve included an example of Penalty A (an employer who offers no coverage) below from our latest white paper (The New Definition of a Full-time Employee Under the Affordable Care Act) so that you can get a visual of how the penalty changes.

With this small change in the employer mandate penalty, the business used in this example would save $100,000 in penalties.

If you are the type that likes to dive head first into IRS regulations, you can find the full 227 page IRS document here.

Have a question related to this latest announcement? Leave it in the comments below!