6 Things You Need to Know About The Health Insurance Marketplaces

By The Bailey Group Staff

Published July 2, 2013

We’re less than 3 months out from open enrollment in the Health Insurance Marketplaces. Do you feel like you have a good grasp on what the marketplace is, what it has to offer and how to even use one?

If your answer is a resounding “no,” don’t worry. You’re not alone. In fact, 45% of Americans have heard nothing at all about the health insurance marketplaces (according to a June 2013 Kaiser Health Tracking Poll). The Obama administration is, of course, trying to push that percentage in a more positive direction. They just launched a new website on Monday and have plans to roll out a series of education efforts this summer.

While we’re waiting for the “all out” Health Care Reform marketing blitz, here are 6 key topics that will help get you up-to-speed on the health insurance marketplaces.

The Basics

Health Insurance Marketplaces (also known as Exchanges) are new organizations that are being set up to create alternative markets for buying health insurance. They will offer a choice of different health plans, certify plans that participate and provide information to help consumers understand their coverage options.

Beginning in 2014, Marketplaces will primarily serve individuals buying insurance on their own and small businesses with up to 100 employees.

The small business marketplaces will be known as Small Business Health Option Programs, or SHOP Exchanges. States may limit employer size to 50 employees for the first two years and can choose to include larger employers in the future.

States can establish their own Marketplaces, which may be run by a government agency or a nonprofit organization. Alternatively, states can have the federal government step in to set up the state’s Marketplace, or can work with the federal government on a partnership Marketplace.

States may create multiple Marketplaces, as long as only one serves each geographic area. States may also work together to form regional Marketplaces. The federal government will offer technical assistance to help states set up Marketplaces.

Who’s Eligible?

Marketplaces will be open to individuals and families without insurance and to those who currently purchase insurance in the individual market. This group will include, for example, early retirees (pre-Medicare-eligible retirees), the self-employed, individuals whose employers do not provide insurance and those who cannot afford their employer’s insurance.

People who are currently insured cannot enroll through a Marketplace. However, individuals who have insurance through their employers may opt out of the employer plan during their renewal period and go to a Marketplace to purchase health insurance.

For an uninsured individual, the only requirements for obtaining insurance through a Marketplace are living in the service area of the Marketplace, being a lawful citizen or U.S. resident and not currently being incarcerated.

One-Stop Shopping

Marketplaces are designed to help individuals find appropriate health insurance. The Marketplace is intended to offer “one-stop shopping” to find and compare private health insurance options.

Maybe the Marketplace will look like one of our favorite travel websites (Hipmunk.com)

In some ways, Marketplaces will be similar to existing travel websites that compare airfare and hotel prices. People using a Marketplace will be able to compare policies sold by different companies. But the Marketplaces will be more complicated than simply comparing price quotes.

Available Plans

Plans offered through a Marketplace are known as “Qualified Health Plans,” or “QHPs.” QHPs will have to offer a set of “essential benefits.” The details of these benefits will differ from state to state, but must include, at a minimum, doctor’s visits and outpatient services, hospitalization, emergency services, maternity and newborn care, pediatric services (including oral and vision), mental health and substance use disorder services, prescription drugs, lab services, preventive medicine and wellness services and chronic disease management.

Annual cost sharing, or the amount consumers must pay that is not covered by insurance, will be capped at the amounts allowed for high deductible health plans. For 2014, those limits are $6,350 for individual policies and $12,700 for family plans.

People who sign up for insurance using a Marketplace may be eligible for subsidies or tax credits if their income falls within a certain range (you can use this calculator from the Kaiser Family Foundation to estimate the subsidy you may receive) . The Marketplaces will also direct people to Medicaid, the government health insurance program for the poor, if they’re eligible.

Purchasing insurance can be confusing, so information on the plan benefits will be standardized in an effort to make it easier to compare cost and quality. Plans will be divided into four different types, based on the level of benefits: bronze, silver, gold and platinum. There will also be a young adults’ plan. Rules on how much insurers can vary premiums based on age or geography are set by federal law, although states could adopt more restrictive rules.

The Marketplaces are also required to operate toll-free hotlines to help consumers choose a plan, determine eligibility for federal subsidies or Medicaid, rate plans based on quality and price and conduct outreach and education.

Implementation Timeline

Open enrollment for health insurance coverage through the Marketplace begins October 1st, 2013 for coverage starting as early as Jan. 1, 2014. At that time, failure to obtain health insurance will result in tax penalties, unless an exemption applies.

Not All Marketplaces Are Created Equal

While Marketplaces will have many similarities, they are not intended to be uniform. Each state is supposed to set up its own Marketplace, though states could group together to form interstate regional Marketplaces.

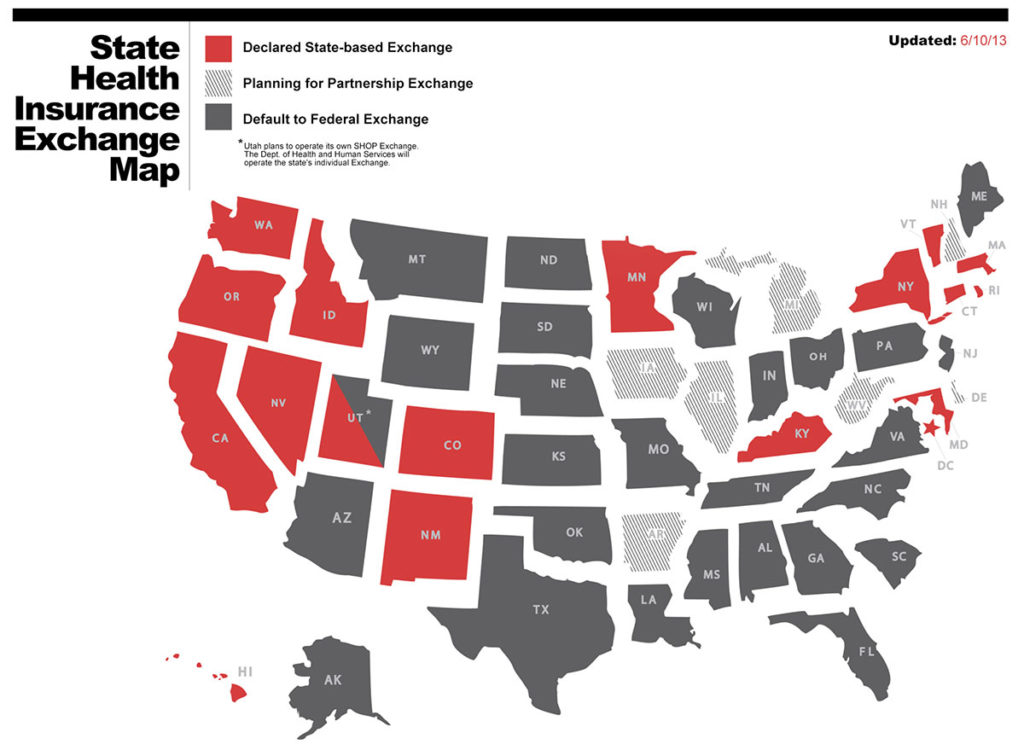

However, only 16 states and Washington, D.C. have announced they will set up their own Marketplaces. Seven states have opted to partner with the federal government and create a Marketplace with shared administrative responsibilities. The remaining 27 states have decided not to set up Marketplaces, ensuring Marketplaces for these states will be run by the federal government.

Because of the different types of Marketplace administration, subtle but important Marketplace differences will likely occur. Differences may also occur between the state-run plans as well.

States that establish their own Marketplaces may decide which insurers participate and whether to require benefits beyond those set under federal law. For instance, they may accept all insurers whose policies meet the law’s requirements, or limit participation by requiring that insurers meet specific quality or pricing guidelines.

California, for example, has chosen to limit the number of insurers in order to select the highest-value plans, while Colorado’s model will accept all plans that meet the requirements. The federal Marketplaces will accept all qualifying plans.

States that build their own Marketplaces may also decide whether to be more proactive in selecting insurers that offer benefits targeted to a state’s particular needs. For example, a state with a high rate of diabetes might select insurers with special programs to combat diabetes.

Some Marketplaces and state insurance commissioners will be able to recommend whether specific insurers should be allowed to sell in the exchange, partly based on their patterns of rate increases.

Hopefully this helps you gain a better understanding of what the marketplaces are and how the landscape of health care is set to change on October 1st. Is there something you still have questions about? Anything we can help you understand just a little bit better? Just leave a comment below and we’ll get back to you as soon as we can.