2018 HSA Limit for Family Coverage Reduced (Update: IRS Reverses Course!)

By The Bailey Group Marketing

Updated April 30, 2018

Originally published April 2, 2018

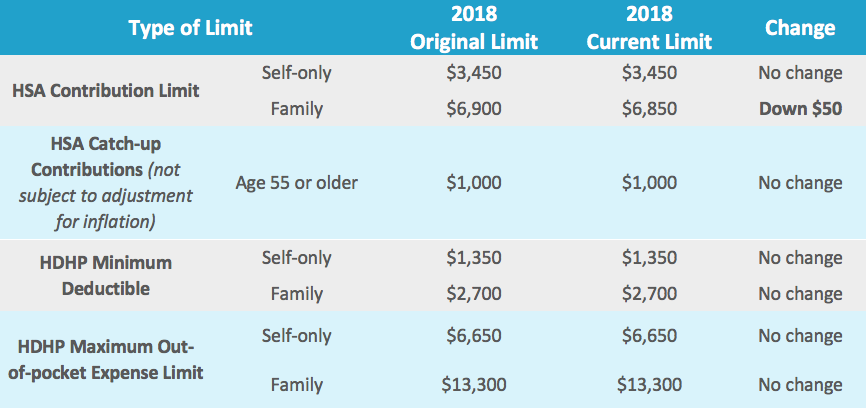

UPDATE: On April 26, 2018, the IRS announced that, for 2018, taxpayers with family high deductible health plan (HDHP) coverage may treat $6,900 as the annual contribution limit to their health savings accounts (HSAs). Employers with HDHPs may want to inform their employees about the HSA contribution limit change for family HDHP coverage. Employees who changed their HSA elections to comply with the reduced limit may wish to change their elections again for the $6,900 limit.

On March 5, 2018, the IRS released Revenue Procedure 2018-18 to announce changes to certain tax limits for 2018, including a reduced contribution limit for health savings accounts (HSAs).

Why the Change?

The new tax law enacted late last year—the Tax Cuts and Jobs Act—changed the consumer price index for making annual adjustments to the HSA limits. Using the new index, the IRS reduced one of the HSA/high deductible health plan (HDHP) limits for 2018—the HSA contribution limit for individuals with family HDHP coverage.

The New Limit

Based on this new index, the IRS lowered the HSA contribution limit for individuals with family coverage under an HDHP from $6,900 to $6,850. This change is effective for the 2018 calendar year.

Action Steps for Employers

Employers with HDHPs should inform employees about the reduced HSA contribution limit for family HDHP coverage. Employees may need to change their HSA elections going forward to comply with the new limit.

Also, any individuals with family HDHP coverage who have already contributed $6,900 for 2018 must receive a refund of the excess contribution in order to avoid an excise tax.