Health Insurance Options: A Guide for Young Adults

By The Bailey Group Marketing

Published March 24, 2017

To many healthy, young adults, skipping health insurance sounds like a fantastic idea. Health insurance is confusing, downright expensive, and doesn’t feel like it’s worth the cost, especially if you don’t need frequent medical care.

The problem, though, with not having health insurance coverage is you never know when a catastrophic accident or illness may strike. Without health insurance coverage to protect you from skyrocketing medical costs, you can quickly end up in serious financial trouble.

The bigger problem, I believe, for many young adults when it comes to getting covered is that they just don’t know where to start.

Where do I even go to get a health insurance plan?

Is there anybody I can talk to?

How long am I allowed stay on my parent’s plan?

Should I get coverage through my job or an individual plan?

So, instead of just telling you “Hey! You need to get covered. It’s the right thing to do!” and leaving it at that, we’re going to help educate you on the different options available to you as a young adult getting started in this big scary world of health care.

Health Insurance Through Your Employer

Many employers offer health coverage to employees as a benefit of employment. In addition, the ACA currently requires certain large employers (with over 50 full-time equivalent employees) to provide affordable, minimum value health coverage to their full-time employees working over 30 hours per week.

Keep in mind that the above could change under President Trump’s plan to repeal and replace the ACA, although historically most large groups have always offered benefits as a recruitment and retention tool.

There are several advantages of choosing an employer-based health plan:

- Risk is spread among the entire group so plan premiums are usually lower.

- Your employer may also cover part of the premium cost.

- You may be able to choose from a number of different plans, depending on the choices offered by your employer.

- Participants in group health plans are also covered by federal benefits laws, which guarantee things like special enrollment rights and protection from discrimination based on your health status.

Enrollment in an employer-based plan generally occurs through two regular opportunities: an initial enrollment period when you are hired (or first become eligible) and an annual open enrollment period. In many cases, the only exception to these enrollment rules is if you qualify for a special enrollment period (SEP).

The Health Insurance Portability and Accountability Act (HIPAA) is a federal law that requires employers to provide an SEP of at least 30 days following one of these situations:

- Loss of eligibility for other coverage (such as turning 26 and losing coverage on your parent’s plan).

- Getting married or divorced.

- Having or adopting children.

- Becoming eligible or losing eligibility for Medicaid.

If you’re interested in learning about your job-based coverage options, the best person to speak with is your company’s HR representative.

Health Insurance Through Your Parent’s Plan

Quite often, young adults are able to be covered under a parent’s health plan until the age of 26. If your parent’s plan offers dependent coverage, you are eligible until you turn 26, whether or not you are married, living with your parents, eligible for coverage through your own employer, financially dependent on your parent or are a student. However, it is up to your parent whether you can be covered under his or her plan.

One advantage of being enrolled in your parent’s plan is that you don’t have to shop for coverage.

Finding your own health coverage can be an intimidating and confusing process. If you’re already familiar with the benefits and medical providers you have access to under your parent’s plan, it can be stressful to seek out new providers.

Another advantage is that the premium cost may be lower than the cost of coverage you would get on your own.

The coverage you get through your parent’s plan may be less expensive per person than individual plans, and, if there are already other dependents on your parent’s plan, adding you may not cost them anything at all.

Better yet, If you live near your parents, you can avoid paying the expensive out-of-network rates you may face if you were living far away.

Remaining on your parent’s plan has its fair share of disadvantages.

Many employer-based plans stop providing coverage for young adults on their parent’s plan during the month of their 26th birthday leaving you high and dry to find a new plan elsewhere.

Another disadvantage is that, because policyholders receive a comprehensive summary of benefits, your parents may potentially get more information about your health care than you would like. If you prefer privacy or independence, you should consider seeking coverage on your own.

Also, if you are planning to get married or have a baby, your own dependents aren’t eligible for coverage under your parent’s plan.

In order to best prepare for your future, you should consider one day finding health insurance for you and your family.

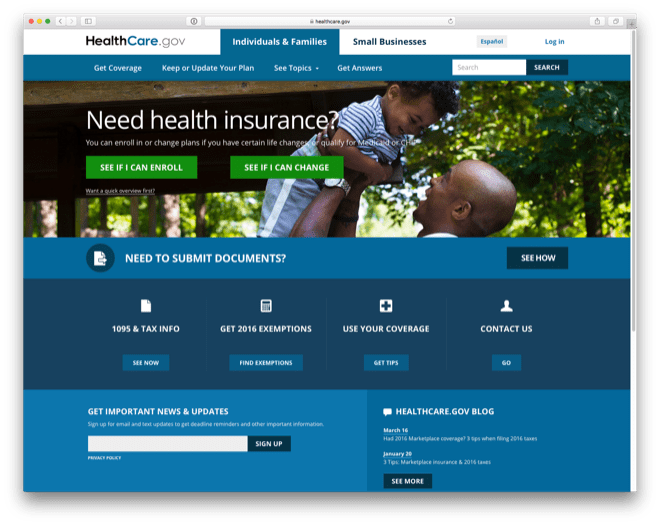

Health Insurance Through the Marketplace

The Marketplace allows individuals to compare health insurance options and purchase coverage online. Some people are even able to receive subsidies to help pay for premiums and out-of-pocket expenses.

However, you will not be eligible for subsidies if you were offered health insurance (for example, by your employer or a spouse or parent’s plan) that was affordable and covered at least an average of 60 percent of health care costs. Even without subsidies, you may be able to find a health insurance option that fits your budget.

In addition to comprehensive health insurance coverage, you may be eligible for a “catastrophic plan.” These plans are available only to those under 30 years of age and generally have very low premiums and very high deductibles. Although this type of plan covers only the most essential health needs in order to fulfill the ACA requirements, the main purpose of this plan is to protect you from the substantial medical costs that can be incurred from a serious accident or illness.

Marketplace enrollment is only available during an annual open enrollment period, unless you qualify for a SEP. The rules for SEPs in the Marketplace differ from those that apply to employer-based plans.

Health Insurance Through an Individual Plan

Many health insurance companies offer individual plans off of the Health Insurance Marketplace (otherwise known as Healthcare.gov). Obtaining health insurance through a third party may be the best fit for you if you know exactly what you want. Because this option is not a group health plan, individual health insurance may be more expensive than other options.

The level and quality of the coverage will vary, depending on the specific policy. Typically, higher quality plans come with higher premiums.

In addition, carriers may limit enrollment to specific times during the year, similar to the Marketplace.

Health Insurance Through Medicaid

Medicaid is a program that is designed to help provide health coverage to low-income adults. Medicaid does not have a specific open enrollment period, which means that you may apply at any time.

More details about applying for Medicaid in Florida can be found here.

That wraps up this comprehensive list of options.

We’d be happy to help get you off on the right foot on your health insurance journey. If you’re in Florida and in the market for a Florida Blue plan, we can help you narrow down your choices and get you enrolled – at no additional cost. Simply click the Start a Quote button in the top right to get the process started.