A Short Story About Health Insurance in the American South

By Hannah Ferris

Published June 13, 2014

When I first moved to Florida from New Jersey, I was culture shocked. I was a Yankee who associated Florida with Disney vacations. My understanding of culture in the South was almost entirely based on the movie Forrest Gump.

I learned that things are different here – politics, especially. A great deal of the national debate about the Affordable Care Act (ACA) is related to its success below the Mason-Dixon Line.

The Kaiser Family Foundation released a report in April entitled “Health Coverage and Care in the South in 2014 and Beyond.” It explains the various influences on the health insurance situations of Southerners. These include geography, employment trends, race and immigration status of residents, and of course, politics. It also explains how the ACA has the potential to improve health insurance and care in the Southern U.S.

Southern Demographics

The population of the South is large – and it’s getting larger. In fact, a majority (37%) of Americans live in 1 of the 17 Southern states defined by the U.S. Census Bureau as such. The population of the South is growing as a result of both domestic migration (hello, Florida snowbirds!) and international migration.

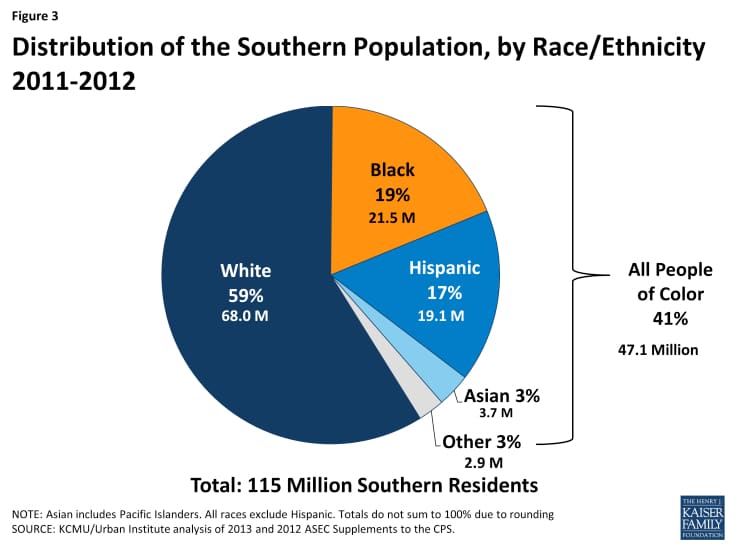

The population of the South is also racially and ethnically diverse. 41% of Southern residents are of African American or Hispanic descent. 11% of people residing in the Southern states are first generation immigrants. Some of these folks are not yet U.S. citizens.

A major hindrance to Southerners’ access to health coverage is their propensity to poverty. States like Louisiana and Mississippi have the highest rates of poverty in the U.S. The high incidence of poverty in the South stems from employment trends. Many Southerners work in the service and agricultural industries, and most of these employers are small businesses. Many small businesses don’t offer health insurance. Even if they did – before the ACA, it may not have been affordable for all.

It’s also important to note that more Southerners live in rural areas compared those up North. When you live in a rural area, access to health care despite your insured status may also be complicated.

Southern Health Insurance Trends Pre-ACA

The health insurance situation in the South before the ACA was characterized by two main factors:

1. high rates of uninsured residents; and

2. lack of access to care.

Political scientists (like me) often claim that unique human geography makes social development difficult. The demographic and socioeconomic factors described above contribute to these two trends.

Now I’ll quit the political science talk and tell you why this matters. Insurance and access to health care services are especially important for Southerners. Southern residents have a higher prevalence of chronic health conditions like heart disease and diabetes. Access to both preventive and primary care are important especially for such at-risk populations. However, access is to care is complicated when you don’t have health insurance…

Impact of the ACA on Southern Health Insurance

The ACA gave hope to many uninsured Southerners. But political barriers to implementing the needed reforms appear to have made getting covered difficult for some. While an impressive number of Southerners received tax credits and purchased a health plan, many were not so lucky. The income rules about getting tax credits or becoming eligible for Medicaid are tricky.

And if a Southerner didn’t qualify for a credit, he or she might be in a bind if his or her state, like Florida, didn’t expand Medicaid as a coverage option. Medicaid is the federally funded health coverage program for the poor. Expanding Medicaid was optional for each state – and many Southern states have been conservative about accepting federal funds to do so. Unfortunately, this has left many Southerners in a “coverage gap” between subsided marketplace plans and Medicaid.

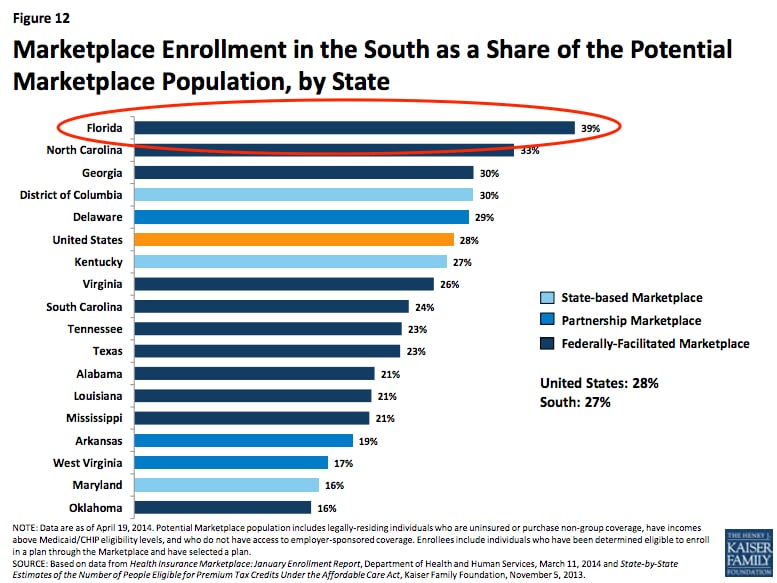

The best solution for those in the coverage gap is political compromise. Luckily, state legislatures are warming to the idea of expanding Medicaid and promoting the use of exchanges for next year. On the brighter side, many Southerners were able to get new coverage through the marketplaces. Both Texas and Florida, the most heavily populated Southern states, exceeded enrollment expectations!

Focus on Florida

Florida is a special state. When I met people during my year abroad, they would associate my Florida residency with unlimited access to Disney World and club music by Pitbull. So, Florida is known for cultural diversity. And this diversity has been a large part of the reason that health insurance coverage in Florida has been so controversial.

Florida is one of the most populated American states with over 18 million residents. Like the South in general, Florida also has unique human geography. Florida is home to many older citizens, many racially and ethnically diverse citizens, many who have chronic health conditions, and many who have no health insurance. The case for reform is thus strong. However, political opposition to the mandates of the ACA is also strong.

In 2011, Florida had the fourth highest rate of uninsured residents. 3.8 million Floridians, about 20% of the state’s population, were uninsured. Florida is one of the 27 states that used the federal Health Insurance Marketplace beginning in late 2013. The state did not accept funds to create its own exchange, nor did it accept funds to expand Medicaid. The Kaiser Foundation estimates that about 764,000 poor, uninsured Floridians will be left in the coverage gap in 2014.

Despite these dismal statistics, Floridians turned out in large numbers for the inaugural open enrollment period. Of the estimated 3.8 million uninsured, 2.5 million were eligible to buy marketplace plans. Of these 2.5 million, 983,775 people actually bought plans.

This number gave Florida the second highest number of enrollees, which was pretty impressive!

Hannah Ferris was a past intern at the Bailey Group. Her interests in social policy and public health yield unique insights into health care reform. Ferris entered the MSc Social Policy and Development program at the London School of Economics in 2014. She loves traveling, fashion, and writing her own personal blog, "Hannah's Happenings."