Choosing Between Medicare Advantage and Medigap

By Hannah Ferris

Published February 21, 2014

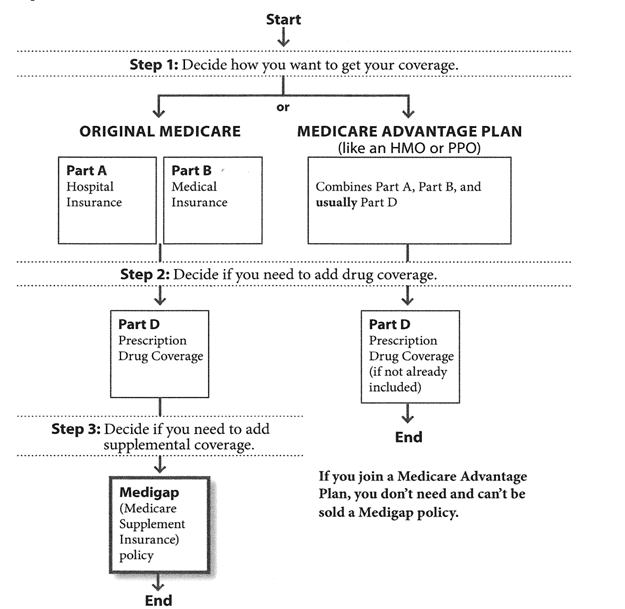

Once you become eligible for Medicare, understanding the benefits offered by different plans and choosing a plan that best fits your needs is the next, and perhaps most important, step for obtaining Medicare coverage.

Choosing between a Medicare Advantage (MA or Part C) Plan or a combination of Original Medicare with supplementary (Medigap) coverage may be a tedious process. This post should help you discern the differences between the two.

Medicare Advantage vs. Medigap

Medicare Advantage

Medicare Advantage, or “Part C“, is a set of Medicare-sponsored insurance plans that organize both Part A and Part B benefits and in most instances, provide extra benefits to their subscribers. To enroll in a Medicare Advantage plan, an individual must be previously enrolled in both Parts A and B of Medicare.

6 Important Facts To Know About Medicare Advantage Plans:

- You are still in the Medicare program, with all the same rights and protections;

- MA plans are offered by private companies that contract with Medicare – Medicare pays these companies to cover your Part A and Part B benefits in addition to any extra benefits the private company chooses to offer;

- A monthly premium, determined by the private company, is paid for any extra benefits;

- MA plans may take various forms, including: health maintenance organizations (HMOs), preferred provider organizations (PPOs), or even a medical savings account (MSA);

- Plan rules (i.e. obtaining referrals) will apply and must be followed to ensure the curbing of subscribers’ costs;

- Prescription drug coverage may be included in an MA plan (if it is not, buying Part D coverage may be encouraged).

Medigap

Medigap policies are health insurance plans marketed and sold by private insurance companies to provide supplementary insurance, covering some of the out-of-pocket costs, or “gaps” in Original Medicare. To enroll in a Medigap plan, an individual must be previously enrolled in both Parts A and B of Medicare.

6 Important Facts To Know About Medigap Plans:

- You cannot have both a Medigap and a Medicare Advantage plan – this is illegal!

- A monthly premium, determined by the private company, is paid for the extra benefits in addition to and separate from the Part B premium that you pay;

- When paying for health services, Medicare will pay its share first, and your Medigap policy will assume the role of secondary payer as per the coordination of benefits rules for supplemental and other health insurers;

- Prescription drug coverage cannot be included in Medigap policies, thus, buying Part D coverage may be advisable;

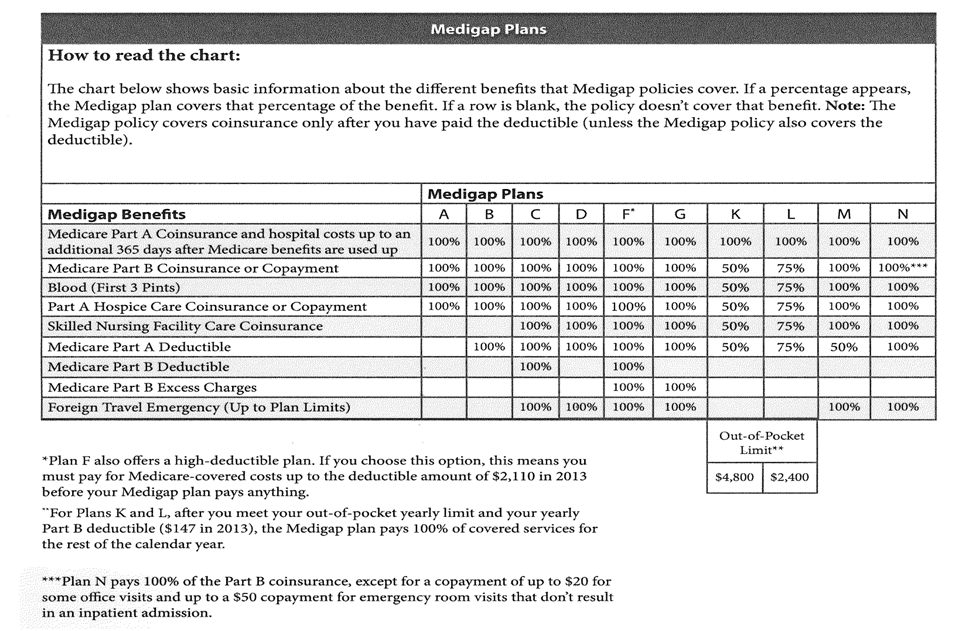

- Cost is the only difference between Medigap policies with the same “letter” sold by different companies;

- Medigap policies are legally standardized and thus include the same benefits

The following chart is a useful tool produced by the federal government for comparing Medigap policies:

For more information on choosing either a Medicare Advantage or a Medigap policy, you may visit any of the listed resources in the previous installment of the Bailey Group’s Guide to Medicare or contact one of our individual agents for help.

Hannah Ferris was a past intern at the Bailey Group. Her interests in social policy and public health yield unique insights into health care reform. Ferris entered the MSc Social Policy and Development program at the London School of Economics in 2014. She loves traveling, fashion, and writing her own personal blog, "Hannah's Happenings."