3 Ways to Make the Most of Your Florida Blue Health Insurance Policy

By The Bailey Group Marketing

Published June 10, 2014

There are many things in life that no one tells you about. You know, the things you have to go learn more about on your own, without the guidance of a parent or friend.

For me, that’s lawn mowing.

My Dad just isn’t a handyman and mowing the lawn is one skill I’ll have to learn through YouTube or Google.

Using your health insurance properly is another one of those skills that no one ever really educates you on; you just try to learn as you go.

Well, lucky you, because I’m about to give you 3 ways to make the most of your Florida Blue health insurance policy that will help save you time, money, and frustration.

Since we’re a local agency for Florida Blue, most of this will be geared towards members with Florida Blue policies. However, check with your carrier to see if they have similar programs and features. I can almost guarantee that they do.

1. Blue365

A little known benefit of being a member with Florida Blue is their Blue 365 program. Blue members can enjoy exclusive health and wellness deals at no extra cost. The goal of the program is to help members maintain a healthy lifestyle, beyond just visiting the doctor’s office.

There are some seriously great deals on there, too. Things like 35% off a pedometer, 12% off Nutrisystem and I’ll personally be taking advantage of the 20% discount on Reebok online purchases – I’ve had my eye on these cool kicks for a while.

There are currently 23 Blue Cross and/or Blue Shield companies participating in the Blue 365 program. Blue Cross and/or Blue Shield promises that more are coming aboard soon.

If you’re not a member with Florida Blue, reach out to your carrier to see if they have a similar program you can join.

2. Shop Your Pharmacy

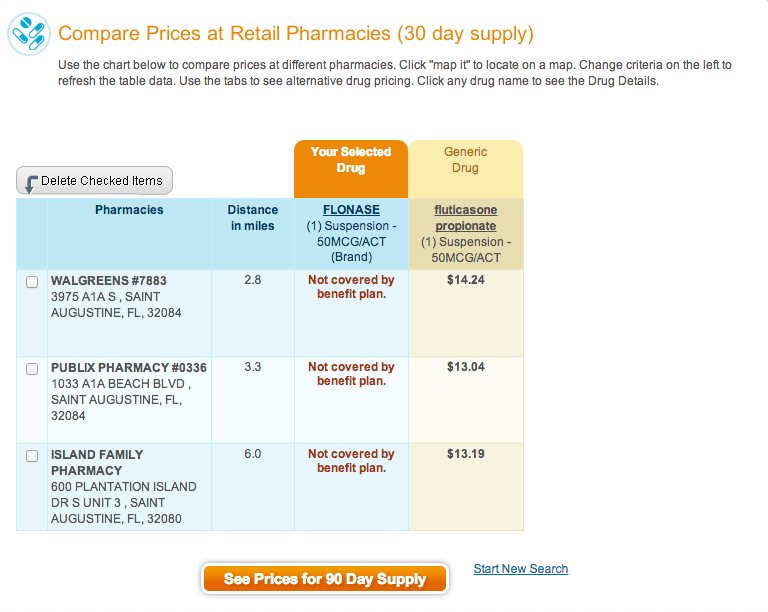

It’s a common thing to assume that prescription drugs cost the same no matter where you shop, but that’s just not the case. Use Florida Blue’s comparison tool to see the price you’ll pay at different pharmacies, plus generic drug options which can save you money.

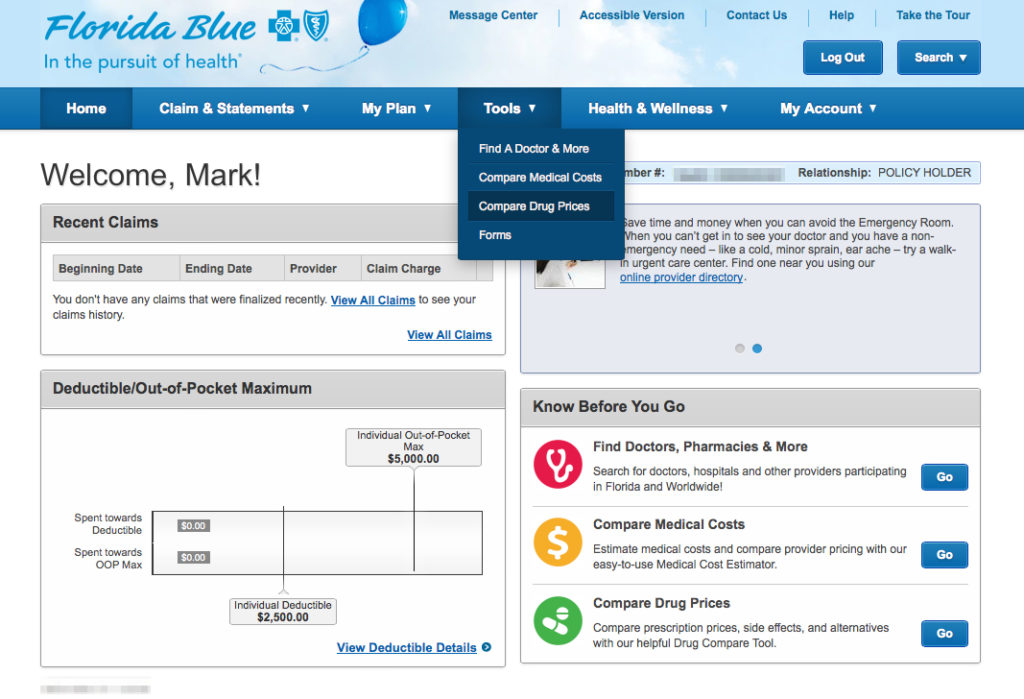

You can find the tool on your personal portal on Florida Blue’s website under the Tools tab.

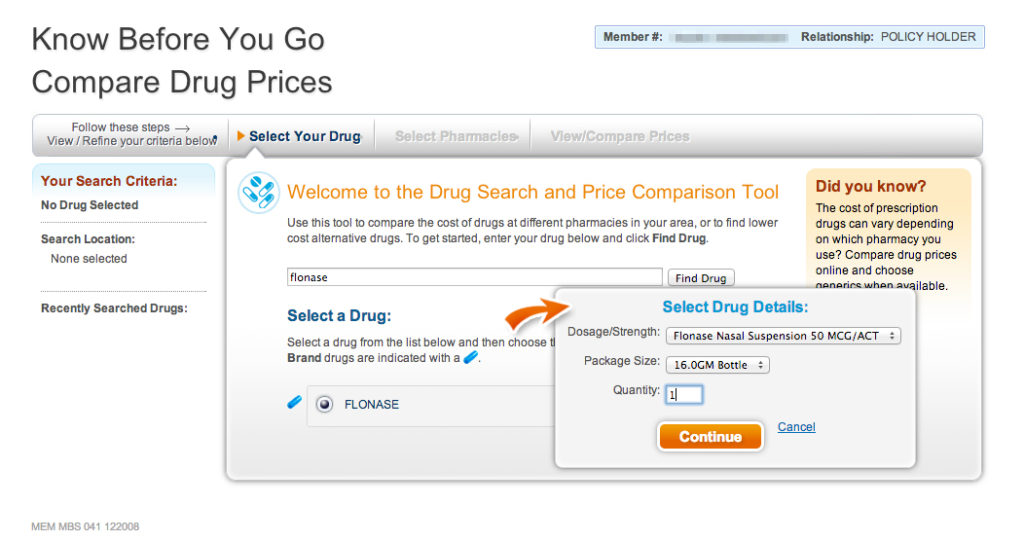

I pretty much live off of Flonase and Zyrtec year-round. All I have to do is search for the drug and enter my typical dosage size and quantity.

I then am able to select up to 5 pharmacies to compare prices at. The great thing about this tool is you can easily see the cost of the brand name drug vs. the generic option.

I’ll probably only end up saving a few bucks on my medication, but I’ll take it! It’s a simple process to do and you really never know how much money you could end up saving.

Also, don’t forget to check for a list of medications that your local supercenter or grocery store offers free or at a reduced rate. Here are the lists for Publix, Wal-Mart, CVS, and Target to get you started.

3. Take An Active Role In Your Healthcare

Have an important surgery coming up? There’s nothing worse than finding out that you could have saved hundreds of dollars just by choosing a different doctor or surgery center. Decisions related to your health and finances should not be taken lightly. I think the biggest obstacle oftentimes is not knowing exactly where to start your research process related to these types of things.

As a Florida Blue member, I’ll give you a few places you can go to do some research before any procedure or diagnostic test:

- Call a Care Consultant – A Care Consultant can easily compare the quality and cost of different providers, plus help you find a specialist or understand your treatment options. Just call 1-888-476-2227.

- Compare Medical Costs on Florida Blue’s website – Members can use their personalized portal to research the cost of typical medical procedures. You can even narrow down to specific facilities where you’d have that certain procedure done in your area.

- Call Your Agent – If you used an agent or broker (like The Bailey Group) to purchase your health insurance, call them! That’s the benefit of using an agent as opposed to buying health insurance on your own. Your agent should always be there to answer questions as they come up.

Also, try to abide by these 5 golden rules when possible:

- Ask if your doctor is in-network

- Use Quest Diagnostics for lab services (Within Florida Only)

- Use Generic Drugs

- Use independent/freestanding diagnostic imaging centers

- Use walk in clinics instead of the emergency room for non-emergencies

These 3 tips should really help you get the most out of your new or existing Florida Blue health insurance policy.